what is ebitda formula definition explanation

In this blog we will cover what is pre-money valuation, why it is important & how it affects your business.

This term may sound complex but it is important for anyone who wants to raise funds for their startup. Understanding this concept can help you attract investors, taking financial decisions & creating an overall plan for your company for future growth.

What is pre-money valuation?

It is the valuation of a company before it receives any new funding. It is the worth of the business based on its current assets, performance & potential.

Let us understand it with an example-

If your startup is valued at 1 million before an investor invests 50000 then the pre-money valuation is 1 million.

This valuation will decide how much ownership the new investors will get in exchange for their investment. If your pre-money valuation is higher it means you will give less equity to investors.

On the other hand if it is lower it might mean giving up more equity in your company.

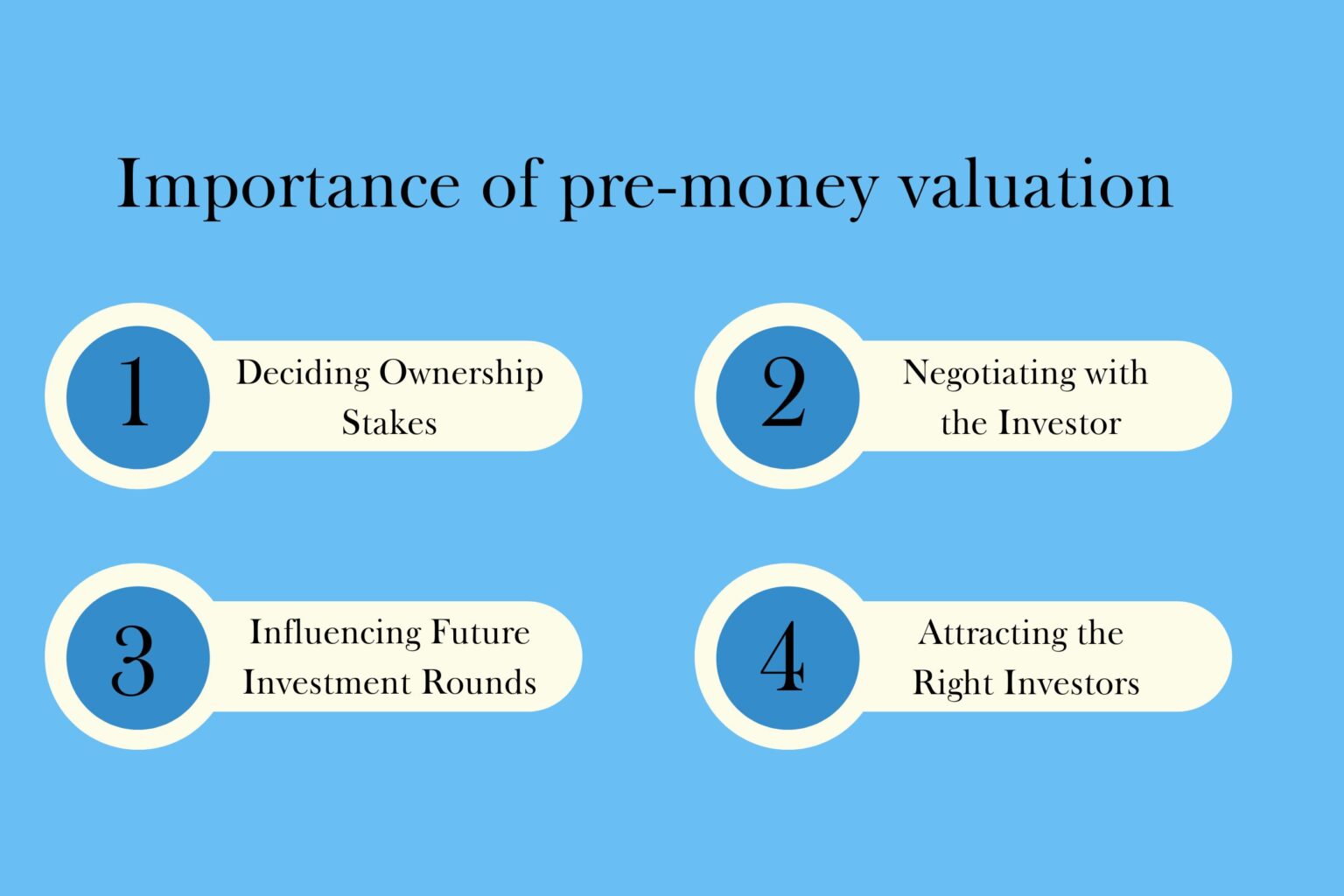

Importance of pre-money valuation

There are a number of benefits of pre-money valuation as it determines the future financial health of business & overall ownership structure.

Here are some of the most important benefits of it-

Deciding Ownership Stakes

It tells how much equity an investor will get in exchange for their investment.

For example, if a company has a pre-money valuation of 1 million & an investor decides to invest 250,000 then it becomes 1.25 million. Now the investor will own 20% of the company.

This calculation is important for both founders & investors to understand how ownership is divided.

Influencing Future Investment Rounds

No doubt it influences future investment rounds. A high Pre-money valuation shows that the company is growing & positively impacts future rounds.

On the other hand, a lower valuation makes it harder to raise funds.

Negotiating with the Investor

Knowing your pre-money valuation gives you an idea of your business valuation which ultimately helps in negotiating with the investor. When you understand your company’s worth you can confidently justify your valuation to potential investors.

Attracting the Right Investors

Onboarding the right investor is a dream for every business that understands and appreciates the true value of your company. In order to attract relevant investors you will have to understand your business value first so that you can pitch to potential investors confidently

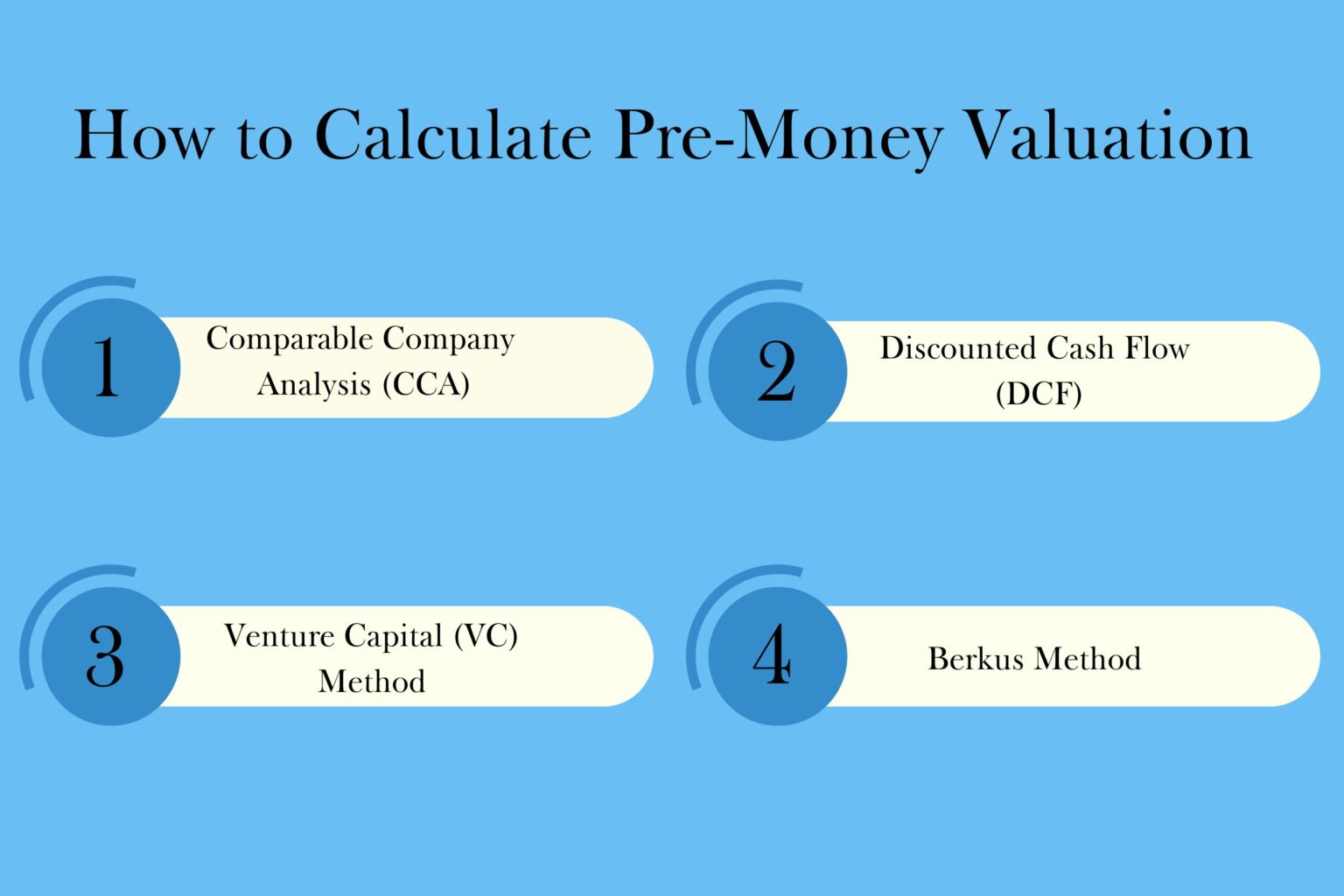

.How to Calculate Pre-Money Valuation

It can be calculated through various methods. Each method offers a different perspective on a company’s total worth which is again based on specific parameters.

Here are some common valuation methods for Calculating it-

Comparable Company Analysis (CCA)

In this method a company is compared with other similar companies that have recently valued or sold. You make comparisons to similar companies in your industry by looking at their revenue, growth rate & market position. It provides a market based valuation that reflects what investors are willing to pay for similar businesses.

Discounted Cash Flow (DCF)

This method is used to estimate the value of your company based on its expected future cash flows. You project the company’s future cash flows & then discount them back to their present value using a discount rate that shows the risk. It is useful for understanding the intrinsic value of your company based on its ability to generate cash in the future.

Venture Capital (VC) Method

This is a common method used by venture capitalists. This method estimates the return on investment by looking at the company’s future value. You estimate the company’s exit value (future sale or IPO) & then work backward to determine the current valuation. It helps in setting realistic expectations for future growth.

Berkus Method

This particular method is used by early stage startups based on qualitative factors. In this method you filter out your company on the basis of competitive advantage, quality of the management team, customer relationships & product sales. It is particularly useful for startups with limited financial history.

Conclusion

Now you have got an idea of what Pre-money valuation & its working principle. How deeply you understand it will impact how much money you can raise & how much of your company you will own after the investment.

It can be calculated by a different valuation method that has its strengths. These methods can be used depending on the stage of your startup. You can also use a combination of methods to get a more accurate valuation.