Growth, Challenges, and Competition: Charting Zepto’s Course in Indian Retail

Zepto is one of the leading players in the Indian retail industry, adapting to the changing consumer landscape with ease.

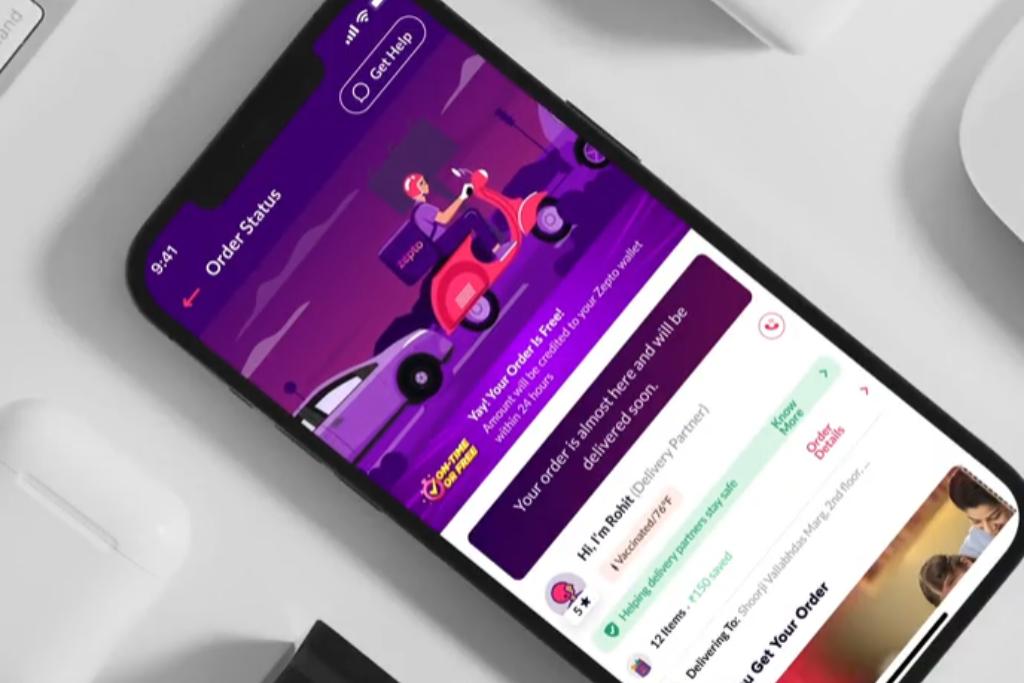

Its success can be attributed to the concept of quick commerce, which has simplified the way we shop.

Zepto has redefined convenience by delivering groceries to our doorsteps in just a few minutes, reflecting the evolving retail preferences of Indians.

Why does Zepto matter?

- Quick Commerce Redefined: Zepto spearheads the quick commerce movement, offering a swift alternative to traditional retail experiences.

- Consumer-Centric Approach: It’s not just about groceries; Zepto’s model reflects a consumer-first philosophy, aligning with changing preferences.

- Convenience Amplified: In a world craving efficiency, Zepto’s role transcends mere transactions – it’s about making daily life simpler.

As we delve into Zepto’s trajectory, we unravel not just a company but a transformative force shaping the very fabric of Indian retail.

The significance lies not in complexity but in how Zepto effortlessly mirrors our desire for seamless, quick, and convenient retail experiences.

How Zepto Tapped into On-Demand Convenience?

Zepto, a rising star in the Indian retail scene, embarked on a remarkable journey from its inception to achieving unicorn status in 2023.

Let’s delve into the key milestones that shaped Zepto’s impressive growth:

- Inception to Unicorn: Zepto’s story began with a vision to redefine retail, and in just a few years, it soared to unicorn status, symbolising its rapid ascent in the market.

- Valuation Milestones: Zepto’s valuation serves as a testament to its growth, reaching close to $1.4 billion. This financial milestone reflects the confidence investors place in its potential.

- Expanding Market Presence: Zepto strategically expanded its market presence, establishing itself as a prominent player in the quick commerce sector. The company’s footprint widened as it catered to the evolving preferences of Indian consumers.

- User Adoption: Zepto’s success is intricately tied to user adoption. The platform witnessed a surge in users, indicating a strong resonance with the convenience-seeking audience.

Zepto’s growth trajectory underscores its ability to navigate the dynamic retail landscape, capturing both market valuation and consumer loyalty.

What is Quick Commerce?

In the ever-evolving world of retail, Quick Commerce (QC) emerges as a game-changer, catering to the fast-paced lives of consumers. Let’s break it down:

- Quick Commerce Defined: QC is about getting your essential items, think groceries or household essentials, delivered swiftly – not in days, but within minutes.

- Why the Shift: With today’s hustle, consumers seek convenience. No more planning days ahead; it’s about instant satisfaction when you need that loaf of bread or fresh veggies.

Zepto’s Quick Commerce Journey:

In essence, Zepto’s prowess lies in embracing the simplicity of quick commerce, aligning seamlessly with the evolving demands of today’s fast-paced consumer landscape.

How Zepto Plans to Overcome Financial Losses?

Zepto’s Financial Landscape: Navigating Losses Towards Profitability

In the financial realm, Zepto’s journey unfolds with a reported net loss of INR 1,272.4 Cr in FY23.

This figure, while seeming substantial, is a common narrative for burgeoning enterprises.

Zepto, however, charts a course for fiscal resilience by targeting EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) profitability by 2025, signifying a strategic commitment to financial health.

Key Points:

In steering through financial nuances, Zepto’s trajectory underscores resilience and strategic foresight, aligning its sails to weather short-term setbacks on the journey toward sustained profitability.

Competition in the Quick Commerce Space

In the bustling quick commerce sector, Zepto navigates competition from various players, both local and global:

- Local Contenders: Zepto faces stiff competition from homegrown quick commerce platforms, such as Dunzo, Blinkit and Swiggy Instamart, which are well-established in the Indian market.

- Global Giants: The quick commerce space sees participation from global players like Zomato and Amazon, adding an extra layer of competition for Zepto.

Despite the crowded field, Zepto stands out by:

- Efficiency Emphasis: Zepto positions itself as a leader in efficient delivery, promising groceries in under 30 minutes, outshining competitors in speed.

- Customer-Centric Approach: With a customer-focused strategy, Zepto aims to meet the evolving needs of Indian consumers, providing a seamless and convenient shopping experience.

What are the Challenges that were Faced by Zepto?

Zepto, on its journey to revolutionise quick commerce in India, has encountered challenges that shed light on the complexities of its growth path:

- Financial Hurdles: In FY23, Zepto reported a net loss of INR 1,272.4 Cr, prompting scrutiny into its financial performance.

- Tax Implications: The potential tax implications of Zepto’s strategic reverse flip have become a focal point. The company is contemplating a share swap, a move that could attract tax liabilities for both investors and the company itself.

- Strategic Reverse Flip: Zepto faces the strategic challenge of executing a reverse flip efficiently. The need for careful planning in this process arises from the desire to redomicile as an Indian entity while mitigating tax burdens.

These challenges underscore the nuanced landscape of quick commerce in India. Zepto’s approach to overcoming these hurdles will play a pivotal role in shaping its future trajectory.

What is reverse flipping? and Zepto’s strategy for the IPO in 2026?

Reverse Flipping Explained:

Reverse flipping is a strategic move where a company changes its country of registration.

Potential Strategies:

Tax Implications and Investor Considerations:

In summary, reverse flipping involves strategic changes in registration, with Zepto weighing tax implications and investor-friendly strategies as it navigates this crucial phase in its growth trajectory.

What are Zepto’s 2026 IPO growth plans?

In Zepto’s forward trajectory, the company aims to debut on the stock market by 2026, marking a pivotal step in its growth strategy.

The Initial Public Offering (IPO) serves as a significant milestone, allowing Zepto to unlock new opportunities and solidify its position in the Indian retail space.

Here’s a snapshot of Zepto’s IPO plans:

As Zepto charts its course towards the IPO, the move signifies more than just a financial transaction – it embodies a strategic move to cement Zepto’s position in India’s evolving retail landscape.

What’s the Market Buzz Around Zepto? Perception and Future Outlook

Zepto has swiftly become a beacon in the quick commerce landscape, but what do people think, and where is it headed?

Market Perception:

Disruption Potential:

Zepto’s Strategies:

In essence, Zepto is not merely a player in the market; it represents a seismic shift towards a more dynamic and responsive retail landscape, resonating with the evolving needs of the everyday consumer.