What is ebitda formula definition explanation

In this blog, we will explain what EBITDA is, how it is used, how to calculate it & its advantages & disadvantages.

We will start with a definition of EBITDA & explaining why it is important for businesses. Then we will show you step-by-step how to calculate EBITDA with a simple formula.

You will also learn about the different ways EBITDA can be used by companies.

Finally, we will discuss the benefits and drawbacks of using EBITDA, so you can understand its strengths and limitations.

After reading our blog, you will have a clear understanding of EBITDA like why it is a valuable parameter for businesses & how it plays an important role in making financial decisions.

What is EBITDA?

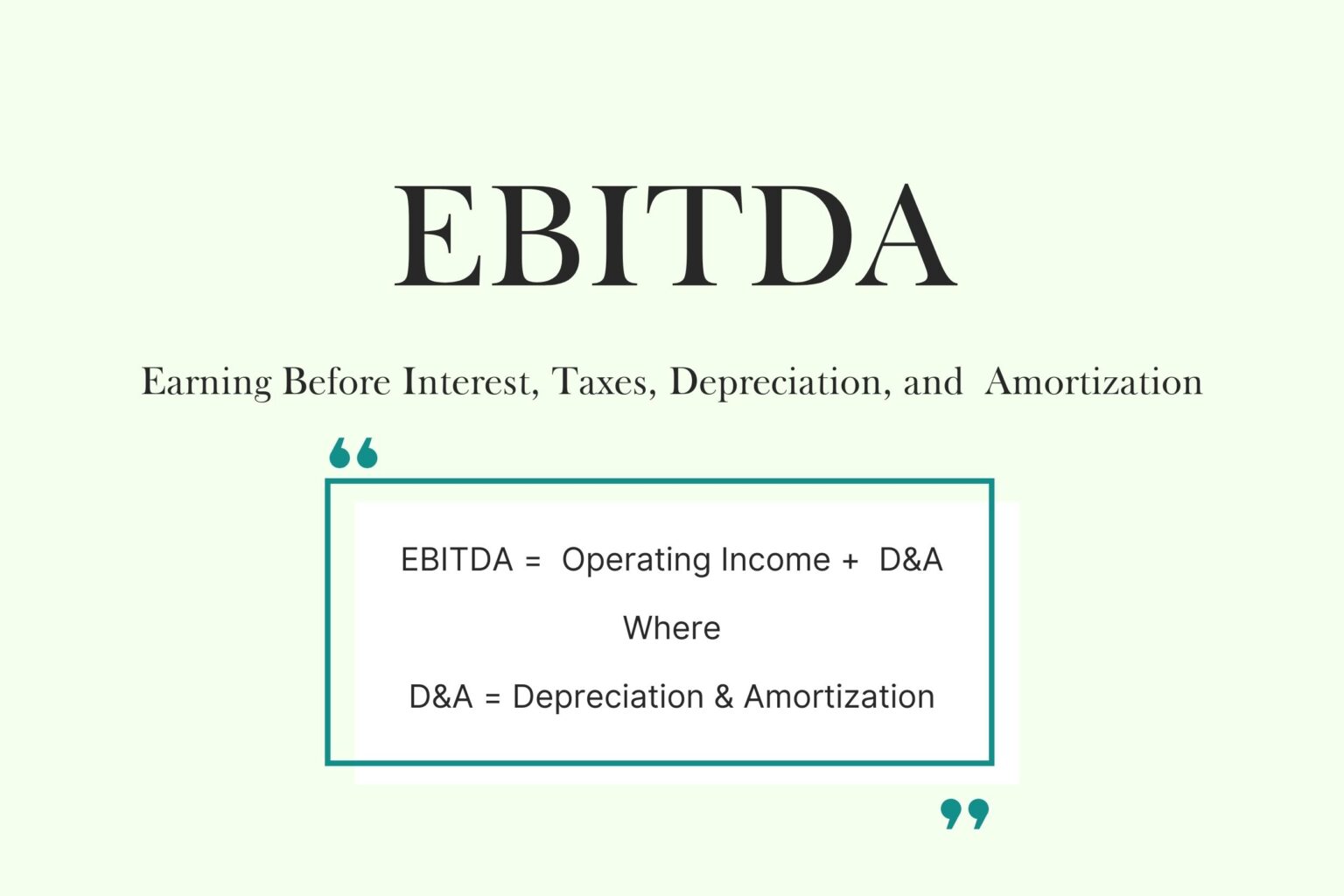

EBITDA full form stands for Earnings Before Interest, Taxes, Depreciation & Amortization. It is a way companies measure how they are performing financially.

EBITDA helps investors & lenders understand how profitable a company is. But, it can sometimes be misleading because it does not show the company’s cash flow.

How is EBITDA Calculated?

EBITDA is usually calculated by taking a company’s net income & adding back expenses for interest, taxes, depreciation & amortization.

There are two main formulas to calculate EBITDA-

EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortization

Companies use this EBITDA formula to understand different parts of their business. Since EBITDA is not a standard accounting measure, companies can choose which expenses to add back to net income.

For example, if an investor wants to see how debt affects a company’s financial health, they might exclude only depreciation & taxes.

Example of EBITDA Calculation

Let us look at an example to understand EBITDA.

Imagine a company called GreenTech for the year ending December 31, 2022.

Here are some details from GreenTech’s income statement-

Total revenue: ₹10,000,000

Cost of revenue: ₹6,000,000

Operating expenses: ₹2,000,000

Selling, general, and administrative expenses: ₹800,000

Interest expense: ₹100,000

Income tax: ₹400,000

Depreciation & amortization: ₹200,000

First, we find GreenTech’s Net Income:

Net Income = Total Revenue – Cost of Revenue – Operating Expenses – Selling, General & Administrative Expenses – Interest Expense – Income Tax

So net income will be:

Net Income = ₹10,000,000 – ₹6,000,000 – ₹2,000,000 – ₹800,000 – ₹100,000 – ₹400,000 = ₹700,000

Next, we calculate EBITDA:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

EBITDA = ₹700,000 + ₹100,000 + ₹400,000 + ₹200,000

EBITDA = ₹1,400,000

So, GreenTech’s EBITDA for the year 2022 is ₹1,400,000.

This calculation helps us understand how much profit GreenTech makes from its core operations before considering interest, taxes, and non-cash expenses.

So here you can compare GreenTech’s performance with other companies.

Advantages of EBITDA

Disadvantages of EBITDA

EBITDA vs Net Income

EBITDA and Net Income are two important measures which are used to evaluate a company’s financial health, but they tell different stories-

EBITDA stands for Earnings Before Interest, Taxes, Depreciation & Amortization. EBITDA shows how much money a company makes from its core operations without considering the costs of interest, taxes & non-cash expenses like depreciation and amortization.

This makes EBITDA useful for comparing companies because it focuses on operational efficiency & ignores other factors like how a company is financed or tax differences. Investors usually look at EBITDA to understand a company’s profitability from its main business activities.

Net Income, also known as “net profit” or “the bottom line,” is the total profit of a company after deducting all expenses including interest, taxes, depreciation & amortization. Net Income provides a complete picture of a company’s financial performance which shows how much money is left after covering all expenses.

This measure is very important for understanding the overall profitability and financial health of a company.

While EBITDA can highlight operational performance and make comparisons easier, it can be misleading because it does not include all costs.

On the other hand, Net Income provides a more accurate view of a company’s actual profitability.

Both metrics are valuable but they serve different purposes & provide different insights.

What is Good EBITDA?

To understand what makes a good EBITDA, it’s helpful to start by knowing why people use it. When you look at a company’s profit, lots of things can affect that number.

For example, if a company has a lot of debt, it might pay a lot in interest. Or, if it bought expensive equipment, the cost of that equipment spreads out over time as depreciation. Taxes can also change the profit number. EBITDA strips all these things away and focuses just on how much money the company makes from its business.

This makes it easier to compare different companies, even if they have different amounts of debt or different tax situations.

So, what makes EBITDA good? It depends on the context.

Here are some things to think about-

Growth Over Time

A good EBITDA is one that grows over time. If a company’s EBITDA is getting bigger each year it might be a sign that the company is going in the right direction. It might be getting more customers selling more products or becoming more efficient.

EBITDA Margin

This is EBITDA as a percentage of total revenue. It shows how much of each rupee of revenue is turned into EBITDA. A higher EBITDA margin means the company is good at controlling its costs & making money from its sales.

For example, if Company A has a 20% EBITDA margin & Company B has a 10% margin then Company A is keeping more money from each rupee of sales.

Comparison with Peers

A good EBITDA is often measured by comparing it with similar companies in the same industry. If one company has a much higher EBITDA than its competitors it is doing better than another company.

Debt Levels

A good EBITDA can also be seen in the context of a company’s debt. If a company has a high EBITDA compared to its debt, it might be in a strong position to pay off its loans. This is often looked at through a ratio called the EBITDA-to-debt ratio.

Cash Flow

EBITDA is sometimes used as a proxy for cash flow. A company with a good EBITDA is often generating a lot of cash from its operations which can be used to invest in growth, pay off debt or return money to shareholders.

In short, a good EBITDA means the company is making solid earnings from its regular business activities. It’s a sign that the company is healthy and might be a good investment. However, it’s just one metric and should be looked at alongside other financial measures to get a complete picture of a company’s health.

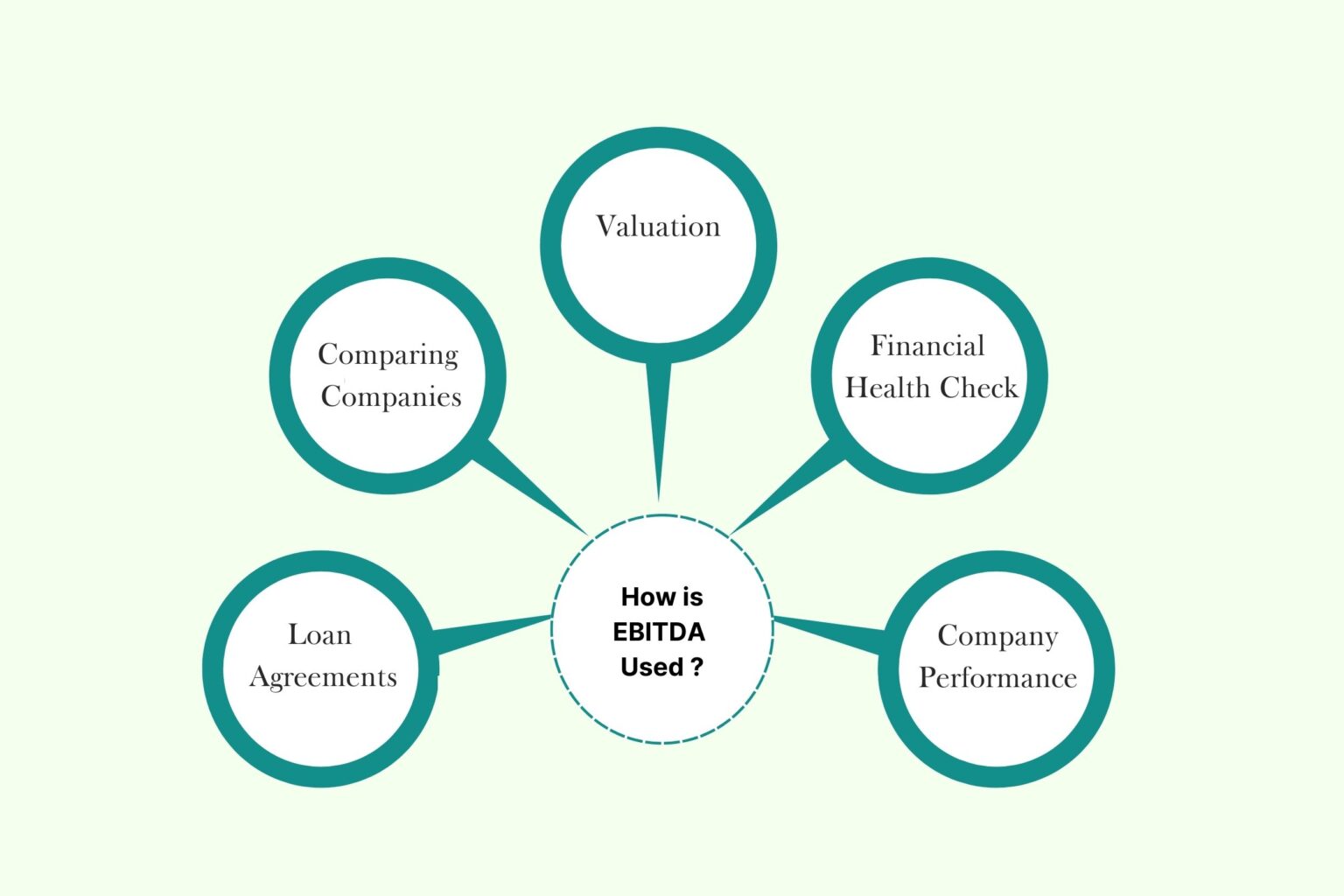

How is EBITDA Used ?

Comparing Companies

Investors & analysts use EBITDA to compare different companies, especially those in the same industry. Since EBITDA excludes interest, taxes & non-cash expenses like depreciation & amortization, it makes it easier to see which company is performing better based purely on its operations.

Valuation

When someone is thinking about buying a company, they often look at EBITDA. This is because it shows how much money the company makes from its regular business activities. A higher EBITDA generally means the company is generating more cash from its operations which is a good sign for potential buyers.

Company Performance

For the company’s management, EBITDA is a useful tool to assess how well the business is doing. By focusing on earnings before interest, taxes, depreciation & amortization managers can get a better sense of the company’s operational efficiency.

Loan Agreements

Banks and other lenders often look at EBITDA when deciding whether to give a company a loan. This is because EBITDA gives a good sense of how much cash the company is generating, which is important for paying back loans.

Evaluating Financial Health

EBITDA can also be a sign of financial health. If a company has a strong EBITDA, it means it’s making good money from its main operations. However, it’s important to remember that EBITDA doesn’t show the whole picture. A company could have a high EBITDA but still be struggling with high debt or other financial problems. That’s why it’s used along with other financial metrics.

Conclusions

In summary, EBITDA is a useful measure because it focuses on the core earnings of a company & ignores other factors that can vary widely between businesses like interest, taxes & depreciation.

But note that it is just one piece of the puzzle & it is also important to look at other financial information to get a full picture of a company’s situation.